Debt can feel overwhelming and make life miserable. This article is going to help you make the best decision for your situation.

Make sure you view your credit report before pursuing debt consolidation. The first step to gaining financial freedom is knowing what debt you have. Know exactly how much you owe and to whom you owe it to. You’re not going to be able to develop a solid plan in which you make different choices in the future if you don’t do all of this.

Get a copy of your credit report before embarking on the debt consolidation You need to know how you fix it. Know how much you’re in debt and to whom you owe it to. You can only fix your problem if you aren’t aware of this.

Do you have life insurance policy? You might want to consider cashing in and pay off your debts. Talk to the insurance agent in order to discover how much money you could obtain against the policy. You may be able to borrow against your policy to pay for your debts.

Sometimes, a simple call to a creditor can get you better terms on your account with them. Many creditors are willing to help debtors conquer their debts. Note that some creditors, such as credit card companies, may lower minimum payments but will also prevent you from incurring more debt till your account is paid off.

Let creditors know you are using a debt consolidation firm. They might want to talk about other arrangements with you about making different arrangements. This is crucial since they may not be aware that you’re trying to take care of your bills. It might help if they have information that you’re attempting to get control of your issues under control.

Many creditors are happy to help debtors who is in arrears.

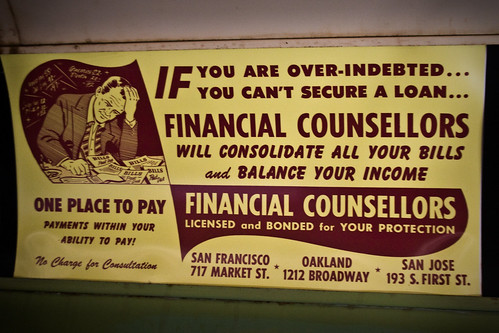

You can get help from debt consolidation firms, but be certain your firm is a reputable one. If something smells fishy, it probably is. Ask a ton of questions and get the answers before you agree to use their services.

Look at how the interest rate is formulated. Fixed interest rates are typically the best. You know exactly what the entire life cycle of the loan will be. Watch out for any debt consolidation that has adjustable rates. This can cost you paying more in the long run.

It is very important to do some background research your financial options along with verifying the reputation of any loan consolidation company that you are planning to sign up with. This will ensure that you to find out who is the right firm.

Do not consider debt consolidation as a quick-fix to your financial problems. Debt is always going to be a problem for you if you do not change your ways. Once you have gotten the right debt consolidation loan, review your finances and spending behavior with a fine-tooth comb, and make some changes so that you don’t find yourself in this situation again.

When in the midst of your consolidation plan, you should consider how you got in your situation. You do not want to acquire debt again within a few years. Try soul-searching to see what caused this doesn’t happen again.

Many creditors will accept as much as 70% of that balance in one lump sum. This will also have no impact on your FICA score; it may even help it.

Your debt consolidation agency will offer personalized recommendations. If you meet with a financial counselor who rushes you, doesn’t know your details and give you a cookie cutter type of financial plan, then don’t waste your money or time on them. A debt counselor should formulate a plan based on your unique situation.

When you are pursuing debt consolidation, decide which debts should be consolidated and which should not. If you have debt on a charge card that doesn’t charge interest, you will want to keep them separate. Go through each and every loan with the lender to make wise decisions.

Debts can really put a stranglehold on your life. However, if you take control of your situation now, things will bet better. Review the debt consolidation advice above do what you need to in order to secure a sound financial foundation going forward.

Inquire about a privacy policy. Inquire about their procedures for storing highly sensitive information. Even ask if their system uses encryption to further protect your information. If the information isn’t encrypted, your identity could get stolen if their computer system is hacked.