Charge cards are helpful to people build credit and really manage their finances efficiently. Knowing how to use a card is important because it will allow one to make smart choices. The credit card basics that can help consumers make educated decisions when it comes to their plastic.

Immediately report any fraudulent charges on a credit card. This will help your creditor catch the person who is using your card fraudulently. Doing this also helps ensure that you will not have to pay for such charges. It usually just takes a brief email or phone call to report fraudulent charges.

You can avoid being late by putting your credit card payments on an automatic payments.

Set yourself a credit spending. You should have a budget for your income, your credit should be included in it. Never get into the habit of seeing credit card as more money. Set aside a limit for yourself on how much you are able to spend for your credit card every month. Stick with it and pay it in full every month.

A lot of companies offer large bonuses for new customers. However, that incredibly fine print listed in your contract could come back to bite you hard. Make sure you read and understand the terms and conditions of any bonuses. Typically, you are required to charge a certain amount on the card in a limited time period to get the bonus.

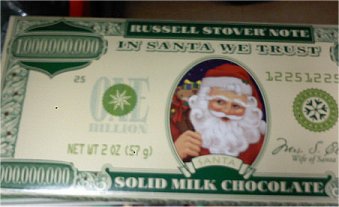

Credit Card

A co-signer is a credit card. Anyone with established credit can be your co-signer.They must be willing to sign stating they will pay the balance if you do not pay for it. This works great for getting a first credit card so that they can start building credit.

If your financial circumstances become more difficult, speak with your card issuer. Oftentimes, the credit card company might work with you to set up a new agreement to help you make a payment under new terms. This could prevent them from having to report late payments to major reporting agencies.

Many charge cards from mailboxes that do not have a locked door on them.

Do not buy anything with your credit card purchases on a public computers. Only make purchases from your personal computer.

It may be unwise to obtain credit cards immediately upon reaching the age of eligibility. Instead, wait a few months and ask questions so that you completely understand the pros and cons to a credit card. You should have a good grasp on the responsibilities that will be required of you as an adult before establishing your first line of credit!

Have a running list you keep of all your credit card account numbers and lender’s emergency contact numbers. Keep this list in a safe place, such as a safety deposit box, separate from all of your cards. The list will prove invaluable if you lose your cards or stolen card.

Contact your creditor about lowering your interest rate. Some companies are willing to lower interest rates charged to customers if their credit relationship is in good standing. It does not cost anything to ask and can save you a lot of money in the end.

A credit card should not be used for purchases you cannot afford. Just because a nice new TV sounds like a great idea, a credit card may be the wrong way to get one. If you can’t pay off the balance right of way, you will risk not being able to make your monthly payments and owing quite a bit of interest. Leave the store and return the next day if you still want to buy the product. If you still want to buy it, you should consider the financing offered by the store, since the interest rates are usually lower.

Credit Card

Keep track of the amount you spend with your credit card expenses are each month. Remember that last-minute or impulse purchases rack up quickly. If you are not watching how much you charge to your credit card, you may be surprised when you get your statement at the months end.

Be careful when you choose to use your credit card for payments online. It is important that any website you are giving your credit card details to is secured. A site that is secure will keep your data confidential. Be very careful when replying to any emails you receive that ask for personal information: you should call the company or go to their website and do not reply to those emails.

Stay away from any card that require annual fee. People who have a healthy credit scores are more likely to be offered cards with no annual fees. Annual fees can serve to erase any benefits the card has. Take a few minutes to run the time to do the calculations. Use a magnifying glass on all those terms if the print is too small.

Following the tips above, an individual can benefit while trying to build credit and manage their finances. You need to understand each card’s terms and benefits in order to make informed choices for yourself. The information you’ve learned here should give you a firm understanding of bank cards and how they can influence your financial situation.

Always remember that interest rates are negotiable. You can often negotiate the rate down a percentage point or two if you contact the credit card issuer. If you are a good customer with a record of making timely payments, they are likely to grant you a better APR upon request.