Is debt consolidation a term you have heard about? You may not be aware of how it could make things better for you, but you might not know how it can help you. If you’ve got several bills that you can’t manage, choosing a great debt consolidation program can make all the difference. The important thing here is to make a good decision.Read this article to find out more about debt consolidation.

Consider the long term when picking out the debt consolidation business that’ll be helping you. Make sure that they can help you tackle your current issues and those that may arise in the future. They may be able to help you avoid getting back into a financial mess by offering some other financial counseling services.

Check out your credit report.You need to know why you are in this position to start with. This helps you from treading down the poor financial path again once you’ve gotten your debt consolidation in order.

Get a copy of your credit report before you decide about debt consolidation journey.The first step to taking care of your debt issues is to understand how they all happened in the first place. Know exactly how much you owe and where that money needs to go. You won’t be able to get anything fixed if you’re not know this information.

If you get an offer in the mail for a credit card with a low rate, think about consolidating your debts with this offer. Along with pocketing saved interest, you will find it more convenient to make just one monthly payment. The single payment would be made to the credit card company, as opposed to making several to individual creditors. After combining all your debts into one credit card, focus on paying it down before that introductory offer ends.

Don’t be fooled by debt consolidation on the grounds that they claim to be a non-profit. Non-profit does not mean that it’s great. Check with the BBB to find the firm is really as great as they claim to be.

You will save on interest and will then only have one payment to make a single payment. Once you get your credit card balances all on one account, focus on completely paying it off prior to the expiration of the introductory interest rate.

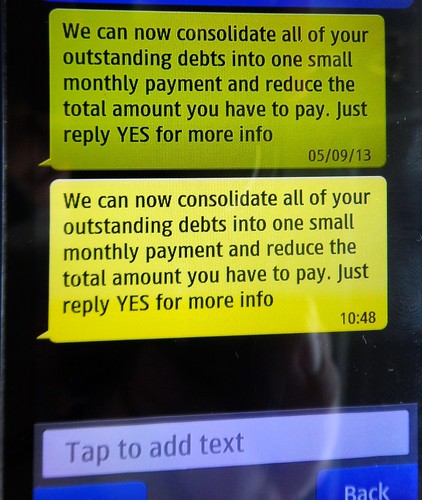

Make sure you don’t borrow money from a company you haven’t researched. When you’re in a bad spot – that is when the loan sharks pounce. Choose a lender who is reputable, trustworthy and comes highly recommended.

Look into exactly how the interest rate is formulated. Fixed interest rates are the best options. This helps you know exactly what’s going to have to be paid during the life of your loan.Watch out for any debt consolidation program with adjustable interest. This can lead to you more interest later on.

It is imperative to fully research your financial options along with verifying the reputation of any loan consolidation companies before hiring a counselor to help you. Doing this helps you make the best decision about moving forward and qualified.

When you get a good debt consolidation plan going, make sure you then start paying for things in cash. It’s important to now steer clear of spending on credit cards again. It’s the exact thing that got you here to begin with! Paying in cash will ensure you don’t incur debt.

You might access your retirement fund to help you get your high-interest credit cards paid off. Only do this if you’re sure you can afford to pay it back within five years. You have to pay tax and penalty if you cannot.

When doing a debt consolidation, make sure to consider which debts are worth consolidating and which should be kept separately. If you have zero interest on something right now, you will want to keep them separate. Go over each loan with the lender to help you make a wise decision.

Completely and thoroughly fill out the paperwork you get from your debt consolidation agency. You should be paying extra close attention to all of this information and detail. Making errors when filling out your paperwork may result in delays.

Debt consolidation can be an excellent strategy for you if you are seeking to eliminate your debt, but this will only work if you are knowledgeable on it. Learn all about each program and use the above article to know what you need to look for. That will guide you to a wise decision.