If used the right way, credit cards can garner some fantastic perks from the points you earn, or you can also have a stress-free wallet as well. Other people who do not utilize the advantages of bank cards smartly choose to charge expensive vacations and end up with a stressful bill later. Keep on reading to figure out what you can do to have and get the most from the use of your credit card.

Only apply for store cards with merchants you shop with often. If a retail store inquires on your credit, the inquiry will affect your credit score, even if you do not open the card. If you have too many inquiries from stores, this can negatively affect your credit score.

Never use a credit card to buy something that is not in your budget. It is okay to buy something you know you can pay for shortly, but do not make large purchases that could put you in a financial bind.

Know the interest rate your card comes with. You must understand the interest rate before agreeing to accept it.

Develop a budget for your current lifestyle. Remember, your credit card’s credit limit is not a target to aim for. Know your monthly income, and only spend what you can pay off in full each month. This will help you to avoid owing interest payments.

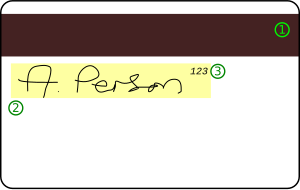

Credit Card

A cosigner can help you obtain a credit card. Anyone who has good credit can be a co-signer.They need to be willing to sign stating they will pay for your balance due on the card if you do not pay it. This is an excellent way to procure your initial credit card that you can use for building credit.

You must make a habit of paying credit card bills in a timely fashion. You should always be aware of when any credit card bills are due so that you do not incur any fees. Furthermore, many credit card providers will increase your interest rate if you fail to pay off your balance in time. This increase will mean that all of the items that you buy in the future with your credit card will cost more.

Always use credit card wisely.Limit spending and only buy things you can afford with that are affordable to you. By carrying a balance, you are making it easier to create additional debt, making it harder to get the balance paid off.

Always make any credit card bills on time.On top of this, the majority of credit card companies reward this behavior by raising interest rates, and this means all future transactions will cost more in the long run.

Don’t start using credit cards to purchase things you aren’t able to afford. Just because a nice new TV sounds like a great idea, a credit card may be the wrong way to get one. You will pay loads of interest, and the monthly payments may be out of your reach. Leave before buying anything, think it through and then return if you want to buy it. If you still want to buy it, you should consider the financing offered by the store, since the interest rates are usually lower.

Many credit cards offer loyalty accounts.If you use your card wisely, you can end up ahead financially.

Do not be hesitant to inquire about getting a lower interest rate in order to lighten your debt load. It may be as simple as making a call and ask; the worst they can do is say no.

Make sure that you are aware of all the recent credit card law changes. For example, a credit card company cannot increase your interest rate retroactively. They are not allowed to operate on double-cycle billing schedules either. Research the relevant laws. Two primary changes that have occurred in recent years involve the Fair Credit Billing Act and the CARD Act.

Don’t believe that interest offered to you is concrete and will stay the same way. Credit card companies normally have several interest rates they can use at their discretion. If you are not happy with your interest rate, make a call and ask the bank to reduce it.

Most professionals say that a credit limit should be no greater than 75% of a monthly salary. If your limit is larger than one month’s salary, you should try paying these cards off as soon as possible. This happens when the amount of interest builds up it becomes too hard to pay back.

Check your card transactions frequently for false charges. You can also get mobile alerts. The alerts will notify you immediately if there are any unusual transactions made. If you are aware of suspicious account activity, call the authorities immediately.

Credit Cards

You don’t have the have cards that offer perks all the time, there are other types of charge cards that can benefit you. As long as you use your charge cards responsibly you will have no problems. If you spend recklessly on your credit cards, however, you could find yourself stressed out due to huge credit card bills. Utilizing this information will help you successfully use your credit cards.

Contact your credit card provider immediately if you think that you have misplaced or lost your card. When you do this you save yourself by making your card invalid so no one can use it. Your credit card company will immediately issue you a new credit card and number.