Is debt consolidation something you’ve heard about? You may know some things, but do not fully understand what is involved. If you owe several different creditors, a debt consolidation may be just what you need. The important thing here is to make a good decision.Read this article for some great knowledge on debt consolidation and how you can use these strategies to get out of debt.

Before starting any debt consolidation program study your credit report. Do this so that you fully understand where you’re at, how you got here and how you can prevent future problems. Learn why you got in debt to help keep you from getting in debt again.

Many creditors will modify payment terms to help debtors who are trying to pay off their debt.

Bankruptcy may be a better choice for some who might otherwise consider debt consolidation. However, when you are already missing payments or unable to continue with payments, then chances are that your debt is already very poor. You can get your debts when you file for bankruptcy.

As you choose a debt consolidation agency, think long-term. You want to manage your debt, but also determine whether the company is going to help you going forward. Some organizations offer services to help you avoid financial problems in the future.

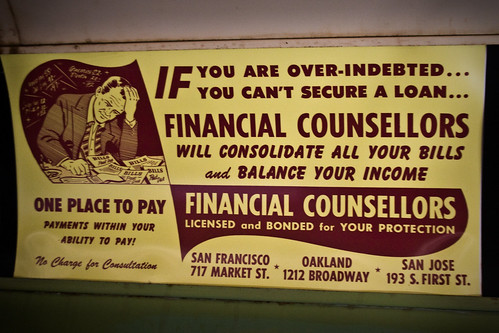

Don’t get money borrowed from pros that you don’t know anything about them. Loan sharks are knowledgeable about you being in financial trouble. If you borrow money for consolidating debt, look for a loan provider who has an excellent reputation and make sure their interest rate is reasonable in comparison to what creditors are charging you.

While going through the debt consolidation process, think about the reasons you got into this position to begin with. You definitely don’t want to repeat the road. Be honest with yourself and learn what made you find this all happened.

You should look into consolidating your debts the next time you receive a low-interest credit card offer in the mail. Along with pocketing saved interest, you will find it more convenient to make just one monthly payment. The single payment would be made to the credit card company, as opposed to making several to individual creditors. Once you have did a balance transfer, pay it off as quickly as possible.

Debt Consolidation

Debt consolidation programs can offer financial help, but you must avoid scams. If something seems too good to be true, do not trust them. Get all of your questions answered before choosing a debt consolidation company.

If you’re a home owner, you might need to think over getting your home refinanced and using that money to help with your financial situation. Mortgage rates have been low lately, and that means now would be a great time if you’d like to consolidate the debts you have this way. Your mortgage payment could end up lower than what you were paying originally.

When doing a debt consolidation, be sure you’re thinking about what debts you have that are worth getting consolidated and which ones shouldn’t be. If some debts have zero interest or an interest rate lower than your consolidation interest rate, then consolidating that loan onto a card with any interest rate higher doesn’t make sense. Go through each loan with the lender to make wise decision.

See if the folks who work at the debt consolidation company employs certified professionals. You can contact NFCC for a list of companies and counselors. This ensures you know you’re making the right decision and using a good company.

Loans from debt consolidation have no impact on your credit rating. Other debt consolidation strategies can negatively impact your credit score, but consolidation loans are designed to help you get lower interest on your debt and help to make one large payment. If you keep up on your payments, it can be an important tool.

You might get financial relief with debt consolidation, but you’ve got to do your research and choose smartly. Take some time out of your day to figure out what this kind of service is all about and be sure you’re taking the advice in this guide to heart as well. It can help you make the best decision for you.