Debt can be a crippling at times. Dealing with it alone can make you wonder what choices do you have. Thankfully, with debt consolidation options, and this article will tell you all about how you can use it to help yourself.

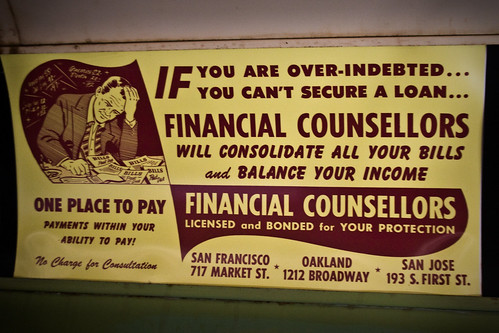

When signing up with a debt consolidation company, you should make sure that the workers there are qualified to do their job. Do they have certification by specific organizations? Do they have a reputable institution backing them to prove legitimacy or strength. This can help you sort out the good companies from the bad.

Get a copy of your credit report before you decide about debt consolidation journey. The first step in debt to be fixed is to figure out what’s causing your problems. Know exactly how much you’re in debt and where that money needs to go. You cannot rebuild your finances if you’re not sure of this.

It is imperative to fully research on different debt consolidation companies before hiring a counselor to help you. Doing this helps you make the best decision when it comes to your financial future since you’ll be dealing with pros that are serious and becoming debt free.

Is a life insurance policy something that you have? Considering cashing in on your policy to pay off your debt. Contact your insurance agent to find out how much you could get against your policy. Sometimes you’re able to borrow just a little of what you’re investing into the policy so you can pay off your debt.

Consumer Credit

Try to find a good consumer credit counselling office in your area. These offices can help you organize your debt and combine your accounts into a single payment. Using a consumer credit counseling service will not hurt credit scores like going elsewhere for debt consolidation.

Refinance your home to help get you in the clear with your debt. Mortgage rates have been low lately, and that means now would be a great time if you’d like to consolidate the debts you have this way. Your mortgage payment could also be much lower than it was originally.

You can use a snowball payment plan as an alternative to debt consolidation. Use the extra money saved that isn’t going to this high interest rate card any more and pay off another debt. This is one of the better alternatives.

Be careful as you fill out debt consolidation agency sends you. This isn’t the time you really need to be paying attention. Mistakes will cause delays in getting you the help you need, so make sure that everything is correct.

When you consolidate your debts, consider what debt is worth consolidating and what must be kept separately. Normally there is no sense in combining a loan with high interest with other loans that have no interest at all. Go over each loan separately and ask the lender to help you make a wise decision.

How did you accumulated your debt?You must determine this before you take on a consolidation loan. Figure out what the issue is, then finding the solution becomes easier.

Debt Consolidation

Rather than using debt consolidation, think about paying off outstanding credit card debt by using the snowball method. This is done by paying off the credit card with the largest interest rate. Then start paying on the next highest interest credit card. This choice is a top one.

Find out where the physical address of your debt consolidation company you’re using is located. Some states don’t require credentials or licenses to create debt consolidation firm to have a license. Make sure your state has regulations before picking a company isn’t doing business in one of these states. You should be able to find that information on the web.

The goal of debt consolidation is to have only one affordable payment you can afford.A payment plan of five years is typically what people go for, but you can go longer or shorter, too. This helps you a reasonable goal and time frame for payoff.

Find out about any hidden fees that a debt consolidation company may charge. You should always receive a fee schedule from any debt consolidator. The staff cannot take your money until service is rendered. Don’t agree to pay them fees to set up your account.

A reputable debt consolidation company is going to assist you in learning what you can stay out of debt. Sign up for classes or workshops that they offer. If the consolidation counselor will not provide you with these tools, keep on looking.

Debt consolidation can help you get your life back on track. This article was written to help people just like you, so you can get your debt under control. Reading this article has given you a great base of knowledge, so put it to use!

Whenever you prepare a list of all your creditors, learn the details of them. This includes the amount your owe, the due date if any, the amount of interest, and the amount of your payments. This information is necessary when it comes to debt consolidation.