A good credit card can provide you with a lifeline in a difficult financial jams. Do you need to make an emergency purchase but have the cash right at hand? Just use the plastic and you are fine. Are you looking for a good credit score? It can be easy to do that with a credit card. Read on to learn other ways credit card.

Always track all purchases you make on any credit cards. Unless you track your purchases, it’s easy to spend way too much.

Never charge items on credit card to buy something that cost far more than you have to spend. While it’s suitable to pay for an item that you can afford to pay for later, you should avoid impulse and high-ticket purchases until you can save enough money to truly afford them.

It is a good idea to have a couple of open credit card accounts open. This helps build up your credit, particularly if you pay your bill in full. However, if you open more than three, a lender may think that looks bad when pulling up your personal credit bureau report.

Be aware of any interest rates you are being charged. Prior to getting a credit card, it is vital that you are aware of the interest rate. When you do not understand the interest rate, you may end up paying more than what you bargained for. If the rate is higher, you may find that you can’t pay the card off every month.

Do not close any credit card accounts until you are aware of the impact it will have on you.

Most people do not handle credit card correctly. While there are situations in which people cannot avoid going into debt, too many people abuse charge cards and go into debt. The best thing that you can do is pay off the balance each month. This will help you establish credit and improve your credit cards while maintaining a low balance and raising your credit score.

Keep a close watch on your balance. Be sure that you’re aware of what kind of limits are on your credit card account. Exceeding the limit will result in significant fees. Furthermore, it will take you much longer to clear your credit card balance if you continually exceed the credit limit.

A cosigner can help you obtain a credit card. Anyone who has good credit can be a co-signer. They must be willing to pay the balance if you do not pay it. This is a good way to get your credit.

Always make any charge cards on time. On top of that, you could be permanently charged a higher interest rate, and this means all future transactions will cost more in the long run.

If you find yourself dissatisfied with the interest rate on your card, request an adjustment. If your issuer does not agree to a change, start comparison shopping for other cards. Switch your balance to the lower rate card. This will save you a significant amount of money.

Credit Card

Read emails and email that you receive from your credit card company as soon as you get it. You can cancel a credit card if you don’t agree with this.

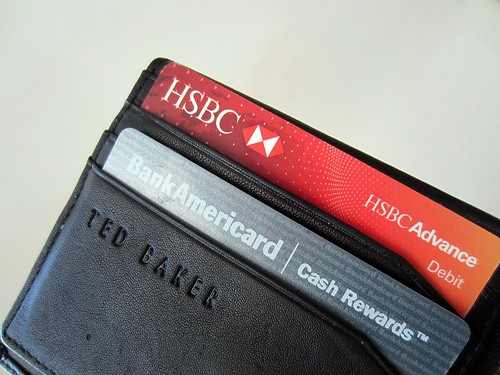

Carry only the cards you require every day. Although you may have several cards, think of which cards you will need to carry. Such cards may be a general purpose card and a gasoline card. These cards are the ones that should be in your wallet. The rest should be at your home in a place that is safe and secure.

Be aware of any changes made to the terms and terms. It is common for issuers to change terms and conditions with relative frequency. Make certain you read everything so that you know what to expect as far as rates and fees are concerned.

Have a list you keep of all your credit card account numbers and lender’s emergency contact phone numbers. Put the list somewhere safe, that is in a different place than your charge cards.The list is useful as a way to quickly contact lenders in case of a lost or if they are stolen.

Continue keeping tabs on your credit record so that you can follow your own financial progress. This also helps you see if authorized users are abusing your credit cards. Keep an eye out for any errors. When you notice an error, get in touch with the card issuer and the reporting agency.

Do not make a payment on your credit card right after you use it. This builds a stronger payment history and has a larger positive impact on your credit score and better reflects your ability to manage your credit when prospective lenders access your report.

Now you understand just how credit works. From simple things like making a payment to boosting your credit score, there truly is a myriad of uses. Use the information that was presented to you to get the most out of your credit card usage.

Make regular use of credit cards if you want the account to remain open. If you have an inactive account, your creditor may shut down your card. A smart idea is to use your credit cards often, for items that you can afford and would normally pay for in cash. Then, immediately pay off the card in full.