This article will give you know more about charge cards and issue avoidance.

If an item truly costs more than you have to spend, don’t use a credit card to buy it. While it is fine to use them for items you may afford later, you should avoid using credit to purchase big ticket items that you are going to run into problems paying for.

Check the details and fine print of credit card offers. If you receive an offer touting a pre-approved card, or a salesperson offers you help in getting the card, gather all the details first. It’s important to understand what your interest rate is and will be in the future. You should also learn about grace periods and any fees that may be applied.

Many people misuse their charge cards in the correct manner. While going into debt is unavoidable sometimes, there are many people who abuse the privileges and end up with payments they cannot afford. The very best strategy is to pay off the balance each month. This will allow you to use your credit rating.

To help be sure you don’t overpay for a premium card, compare its annual fee to rival cards. Annual fees for black or platinum cards can range from $100 to $1000 depending on the card’s exclusivity. If you do not need a card that is exclusive, don’t get one. This way you will avoid the fees.

Always make sure there is not a yearly fee before accepting an exclusive credit card. Annual fees for black or platinum cards can be very high depending on the card’s exclusivity.If you can’t benefit from a premium card, don’t pay the annual fee.

Be smart when using bank cards. Limit spending and just buy things on your credit card that are affordable to you. If you use your card for more than you can afford, your debt will grow and the total balance will be harder to pay off.

Create a spending budget for your credit cards. Many people think a budget is only for the bills you owe; however, you should also set a budget for credit card usage. Your credit card is not extra money, so never view it this way. Know how much you have allotted each month and keep a close eye on your spending to ensure you stick to it. Adhere to that budget, and pay your balance in full each month.

Read and understand all the terms and conditions before signing up for a credit card. Read every word of the fine print so that you understand the card policy completely.

Credit cards can be tied to different kinds of loyalty accounts. If used correctly, you can end up with an extra income stream.

Do not have a pin number or password that would be easy for someone to guess. When you use something such as when you were born or what your middle name is then people can easily get that information.

Retain a sales receipt when making online purchases with your credit card online. Keep these receipts and compare them with your statement to make sure it is the amounts match. File a dispute with your card company if you were overcharged as soon as you discover it. This smart technique will serve you well and ensure that you never get overcharged for purchases.

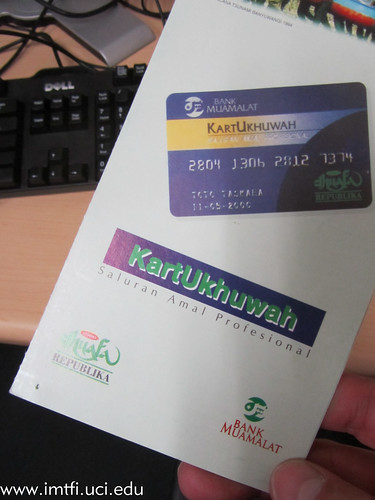

Credit Card Offer

When signing a credit receipt at a store or restaurant, don’t leave anything blank. If your receipt includes a space for indicating a tip, it’s a good idea for you to zero it out or line through it so that an unauthorized amount does not appear on your final bill. Additionally, it’s a good idea to verify the information from all receipts with your monthly statement.

You receive yet another credit card offer. Sometimes you may want a new card, while other times yyou will prefer to pass. Always rip up any credit card offer that you plan on throwing away.

As stated previously in this guide, it is very easy to get in financial trouble if you do not know how to use credit cards. If you spend too much on too many cards, you will be in a tight spot. This article should, hopefully, teach you some ways to avoid the trouble that can find you regarding charge cards, so you can remain financially healthy.

Educate yourself on recent laws affecting consumers using credit cards. Retroactive rate increases are one of the things that the credit companies are restricted from imposing. It’s also against the law for them to bill more than once in a cycle. Research the relevant laws. Two legislative changes have occurred that need to be noted, including the CARD Act.