Are you trying to get your financial situation? Are you at wits end from the pile of bills continuing to arrive in your mail box? If this is you, you may find help with debt consolidation. Continue reading to learn more about how debt consolidation may work for your debt.

Get a copy of your credit report before embarking on the debt consolidation journey. Try identifying which financial practices caused you to end up in debt. Determine who you owe and how much you owe. You won’t be able to get anything fixed if you’re not sure of these things.

Just because a firm is non-profit doesn’t mean they are completely trustworthy and will be fair in their service charges for debt consolidation.Some companies use the nonprofit terminology to lure unsuspecting people in and then hit them with giving you loan terms that are considered quite unfavorable. Check with the BBB.org website to find a highly reputable firm.

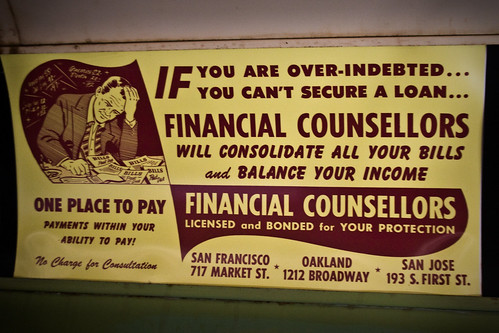

Make sure a debt consolidation service have the proper qualifications. Find out if an organization that certifies debt counselors contain certifications from reputable organizations.Are they backed by reputable company? This lets you know whether or not a company is worthwhile.

You can get a loan taken out so you can pay off your current debts. Then you’ll be able to speak with your creditors so you can see if they’re able to settle with you. Creditors often accept a lump sum of 70 percent. This does not negatively affect your credit rating and can actually increase your credit score.

Consider your best long term options when picking out the debt consolidation business that’ll be helping you. You need to deal with your debts today, and you also need to be sure that you’re going to be able to work with the company well into the future. Some offer services that help you avoid financial problems in the future.

Do you own a life insurance? You can cash it in to pay off the debt. Talk to your agent to see what they can offer you. You can sometimes borrow against your policy to pay for your debt.

Ask the debt consolidation company about the fees they charge. You should always receive a fee schedule from any debt consolidator. The staff cannot take your money until service is rendered. You should make sure you don’t agree to any setup fees when you open an account.

You can actually pay off debt by getting another loan. Talk to multiple financial institutions about interest rates you could expect to pay. Just be sure to pay the loan on time.

Avoid borrowing from a lender that you don’t know anything about. Loan sharks are there to hurt people when they need them. When borrowing money to pay off your debt, find a reputable lender who offers a competitive interest rate.

Maryland and Florida do not require debt consolidation firms to be licensed. It might be best to find one outside of these states. You are not legally protected when working with an unlicensed professional.

Debt consolidation programs can offer financial help, there are certain companies that prey on debtors. If you see offers that are simply too good to be true, you may have fallen into a scam. Get all your questions answered so that you are never left in the dark.

You might be able to remove some money from your retirement fund to help you get your high interest loans. This should only be done unless you’re sure that this money is not paid back into your account. You have to pay taxes and penalty if this doesn’t occur.

If you are dealing with Chapter 13 bankruptcy, debt consolidation can help you retain your property. You can keep your personal and real property if you are able to pay off the debts between three and five years. It is also sometimes possible to reduce or eliminate the interest during the payment process.

Avoid any debt consolidation programs that seem too good to be true. With the right information, you can make a decision that will improve your finances now and in the future. Take the steps you need to to reduce your debt and increase your peace of mind.