Charge cards are useful because they enable individuals to buy items instantly pay for them. Read this article for some great tips on how to be smart about using your credit card advice.

If you cannot afford to pay cash for something, think twice about charging it on your credit card. It is okay to buy something you know you can pay for shortly, but anything you are not sure about should be avoided.

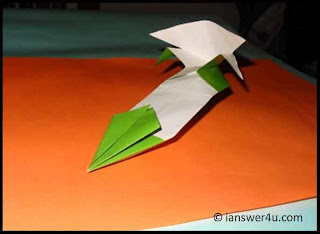

Credit Card

This allows the credit card companies the most opportunity to catch the person responsible. This will also helps absolve you will not be liable for any further charges. You can report fraudulent charges with a quick telephone call to the credit card company.

If you know that someone made a charge on your card without your permission, report it as soon as possible. This allows the credit card issuer the best opportunity to find the offender. It’s also the most efficient way to limit the liability you face for the incurred charges. Many false charges can be fixed with a simple phone call.

The majority of people do not manage their charge cards in the proper manner. While going into debt is unavoidable sometimes, some simply abuse their cards and rack up payments they cannot afford.The very best strategy is to pay off your entire balance each month. This will help you establish credit and improve your credit cards while maintaining a low balance and raising your credit score.

You can save a lot of trouble by putting your credit card payments on an automatic payments.

Many credit cards offer significant bonuses for signing up for a new card. Be sure that you fully understand the fine print, though, because many of these cards have very specific terms that you must meet to qualify for the bonus. Commonly, you are required to spend a particular amount within a couple months of signing up to get the bonus. Check that you can meet this or any other qualifications before signing up; don’t get distracted by excitement over the bonus.

Many retailers will always verify signature matches the one on the back of their credit card can be safe.

Do not use your bank cards to buy items that you cannot afford. Just because your credit limit is high enough to cover that flat-screen television you eyed at the store, a credit card may be the wrong way to get one. You will pay a lot of interest and your monthly payments might be more than you can afford. Make a habit of days. If you are still going to purchase, the store’s in-house financing usually offers lower interest rates.

Do not let anyone borrow your credit card. Even if the friend is a very good one and they are really in need of the card, it just isn’t a smart idea to lend yours out. That can lead to charges for over-limit spending, should your friend charge more than you’ve authorized.

Many credit cards from unlocked mailboxes.

Retain a copy of the receipt when making online purchases with your credit card online. Keep it until you receive your statement to make sure the correct amount. File a dispute if there is any discrepancy. This is necessary to ensure you never get overcharged for your purchases.

A great tip that credit card users can use is to ask for a copy of their credit report every year to make sure that everything is accurate. Take out your card statements, and make sure those amounts equal the recorded amount of debt on your credit history.

Never give in to the temptation to allow anyone borrow your credit card. It could be a very good friend that is in need of one thing or another, but it’s still a bad idea to give it to someone. It may lead to over-limit charges if your friend should put more than you authorized.

This may result in you spend too much money when you see an artificially low balance.

If you are going to be using your credit card to purchase something that is really out of the norm, it’s a smart idea to contact the issuer first. Large purchases or international trips are two good times to notify the company. This will keep identity theft concerns from arising when you use the card.

It is important to be knowledgeable of credit cards. Credit card issuers may not assess retroactive interest rate hikes, for instance. They are also never allowed to operate on double-cycle their billing schedules either. The two major legislative changes recently are the CARD Act as well as the Fair Credit Billing Act.

When used properly, credit cards are quite useful. Those ideas that have been provided in this reading should be able to help you to use your card in a safe and efficient manner while remaining debt free and with a great credit score.

Use your credit cards regularly if you don’t wish to lose them. If you have an inactive account, your creditor may shut down your card. Try using credit cards for things that you have money for, then pay them off right away.